Three jaw-cone-screener plant trains have been bought by Xindadi, a Beijing-based aggregates processing company, who are using the nine machines to process gneiss into 0-8mm and 8-28mm final products for highways and other infrastructure works’ customers in and around China’s capital.

“The customer is able to produce 600 tonnes an hour of material, 200 tonnes an hour with each plant train, and the plants have been working for over 2,000 hours, 16-18 hours a day. He has a full machine servicing package because of the hard nature of the material,” said Simon Unwin, Sandvik sales and applications support manager. “The customer was with us at the first two days of the show and is looking to buy more Sandvik Mobiles’ equipment.”

Unwin said that Chinese aggregates processing customers are moving away from buying Chinese crushing and screening equipment because they like the quality, durability and reliability of the equipment that Sandvik and other leading premium global market manufacturers can supply.

“There’s a big urbanisation process taking place in China which is leading to a lot of construction and demolition waste recycling; this is creating a big potential market for Sandvik’s Prisec impactors,” said Lingnan Hua, Pota product manager for Sandvik Mobile Crushers & Screens.

“There is a lot more environmental regulation coming into the Chinese aggregates sector. The government is trying to merge smaller quarries into bigger ones. They are giving bigger quarries more long-term licenses. With less aggregates suppliers in the market, the price of aggregates will go up.”

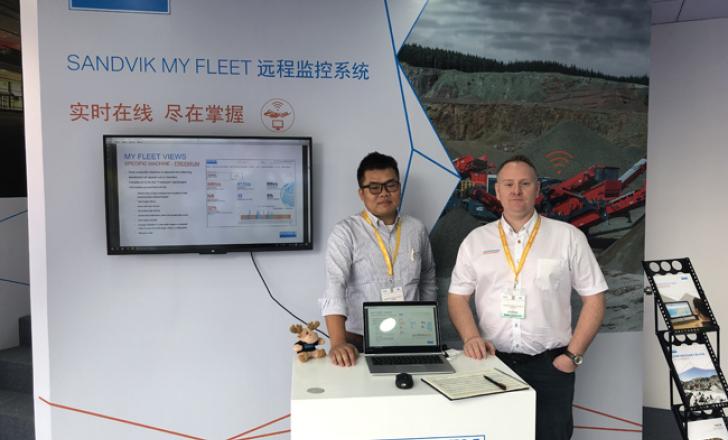

Pota, whose eastern and southern China sales network coverage includes Beijing, Jiangsu, Shanghai and Guangdong, has also this week been promoting Sandvik’s new automation and control telematics system, My Fleet. Developed initially for the Q range of Sandvik mobile crushers, the innovative digital solution provides remote access to critical data on location and machine utilisation, enabling operational machine optimisation. It also assists customers in their planning of service and maintenance schedules, leading to more efficient and cost-effective operations.

“Chinese customers have immediately taken to it,” said Lingnan, “as they are keen to monitor the performance of their machines very closely. Customers also like a nice back story and very much like Sandvik’s long global history in the aggregates business.”

In China, Pota offers customers the complete range of Sandvik Mobiles Crushers & Screens. “There’s big potential here for the larger Sandvik mobile jaw crushers,” said Unwin. “In 2019 in China and elsewhere, we will be making a big push on our U range of heavy duty equipment, including the UJ440i jaw crusher and UH440i mobile cone crusher.”